Fiscal Policy:

TAX BREAK FOR GERMANY:

The policy includes a stimulus package of 23 billion euros. (29 billion US dollars) Since Germany's economy is struggling the government decided to give the people a tax break. The government decided to do a tax break on purchases of new cars, loans for homes and small businesses and money for the roads. They decreased the taxes on large purchases in hope for the consumers to buy and spend their money and help boost the economy.

Although decreasing taxes is a positive thing for the economy in Germany, the unemployment rate may still remain relatively high for awhile until the consumers have confidence and see the economy starting to stabilize. Stability makes consumers feel safe and comfortable with their decisions. Therefore the consumers that do decide to take the risk of buying the commercial properties and making large purchases will help others in making their decision. Success of a new business will boost the confidence of others to start business and create more jobs for the economy.

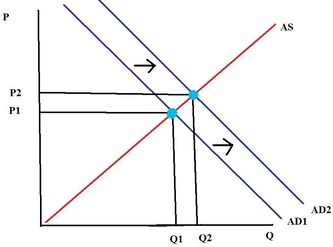

Anticipated Effect: If this policy goes into effect then the diagram shown below will give Germany growth. Since GDP is increasing according to the diagram, then the unemployment percentage will go down. Germany is taking the risk of having possible inflation.

http://www.nytimes.com/2008/11/06/business/worldbusiness/06stimulus.html?_r=1&scp=1&sq=German+Stimulus+plan&st=nyt

The policy includes a stimulus package of 23 billion euros. (29 billion US dollars) Since Germany's economy is struggling the government decided to give the people a tax break. The government decided to do a tax break on purchases of new cars, loans for homes and small businesses and money for the roads. They decreased the taxes on large purchases in hope for the consumers to buy and spend their money and help boost the economy.

- If Germany goes through with the tax breaks on small businesses then it could increase productivity and possibly shift the aggregate supply curve.

Although decreasing taxes is a positive thing for the economy in Germany, the unemployment rate may still remain relatively high for awhile until the consumers have confidence and see the economy starting to stabilize. Stability makes consumers feel safe and comfortable with their decisions. Therefore the consumers that do decide to take the risk of buying the commercial properties and making large purchases will help others in making their decision. Success of a new business will boost the confidence of others to start business and create more jobs for the economy.

Anticipated Effect: If this policy goes into effect then the diagram shown below will give Germany growth. Since GDP is increasing according to the diagram, then the unemployment percentage will go down. Germany is taking the risk of having possible inflation.

http://www.nytimes.com/2008/11/06/business/worldbusiness/06stimulus.html?_r=1&scp=1&sq=German+Stimulus+plan&st=nyt

http://www.euroguide.org/euroguide/subject-listing/Unsecured_loans_for_people_with_bad_credit.html

Monetary Policy:

The monetary policy in Germany deals with mainly the European Central Bank (ECB). Germany doesn't have their own currency anymore. They now use Euros as a form of money exchange. ECB keeps all their interest rates at 1%. ECB interest rate seems to be stable and stay moderate. If increasing the flow of Euros it gives Germany and several other countries to have a possible inflation increase. The demand will shift because of the money that may be released and the supply stays the same. Nothing changes within the supply curve.

Since the interest rates are being lowered and more money is being circulated throughout, I believe that it will give the consumers more confidence to spend their money on those larger purchases. If people are interested in starting their own business it will give them security that the economy is starting to become stable. When people buy and take out loans it gives the economy to produce more jobs.

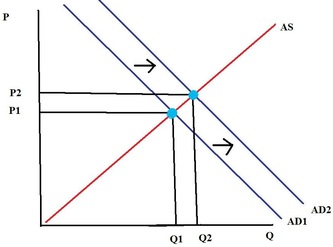

Anticipated Effect: If this policy goes into effect then the diagram shown below will give Germany growth. Since GDP is increasing according to the diagram, then the unemployment percentage will go down. Germany is taking the risk of having possible inflation.

Since the interest rates are being lowered and more money is being circulated throughout, I believe that it will give the consumers more confidence to spend their money on those larger purchases. If people are interested in starting their own business it will give them security that the economy is starting to become stable. When people buy and take out loans it gives the economy to produce more jobs.

Anticipated Effect: If this policy goes into effect then the diagram shown below will give Germany growth. Since GDP is increasing according to the diagram, then the unemployment percentage will go down. Germany is taking the risk of having possible inflation.